29+ Straight Line Method Calculator

The straight line method of depreciation is an especially helpful and effective method of calculating the depreciable. Enter your data as x y pairs and find the.

Premium Photo On The Office Table There Is A Notebook With The Text Due Diligence A Pen A Calculator Dollars Multicolored Paper Clips And A Magnifying Glass Stylish Workplace Business Concept

Web The straight-line method of depreciation is the most common method used to calculate depreciation expense.

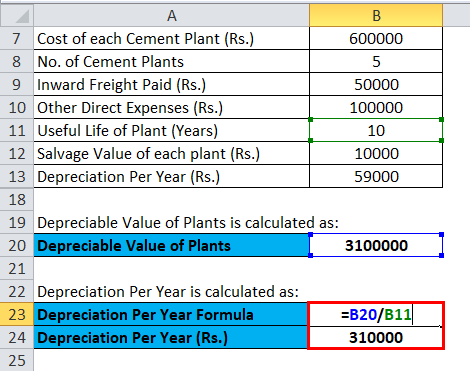

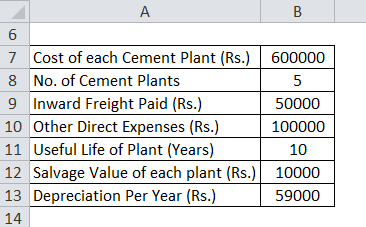

. Web Least Squares Calculator. Depreciable Base 20500 1500 19000 Straight Line Depreciation 1900020 950 Thus Company X. Web This integration of new value is known as interpolating.

Web Straight Line Depreciation Calculator When the value of an asset drops at a set rate over time it is known as straight line depreciation. Web The point-slope calculator is best to unveil and draw the equation of the line. Web Here are steps you can follow to calculate straight-line amortization.

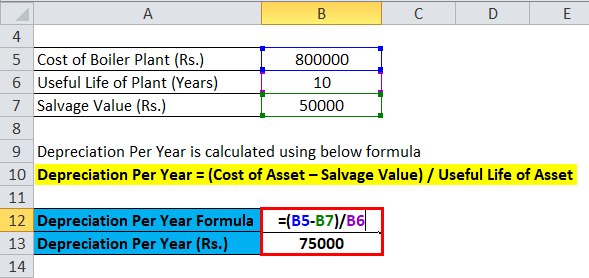

Web Methods to Calculate Straight-line Depreciation Method. The first step involves determining the exact amount. Web The straight line calculation steps are.

Calculate the initial cost of the debt. Web Calculation of Straight-Line Amortization 70000 7 10000 Thus every year 10000 will be charged in the income statement of the company for the next seven years. Web The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate annual or even monthly.

You can calculate subsequent years in the same. Multiply the valuable life of a fixed asset by the depreciable base to determine straight-line depreciation. Web The assets straight line depreciation is.

Web Straight Line method is one such method. Lets take an asset which is worth 10000. Least Squares Regression is a way of finding a straight line that best fits the data called the Line of Best Fit.

Y mx c Where. Determine the cost of the asset. So in the second year your monthly depreciation falls to 30.

Web Second year depreciation 2 x 15 x 900 360. Web The DDB rate of depreciation is twice the straight-line method. It is the simplest method because it equally.

In year one you multiply the cost or beginning book value by 50. The Slope-Intercept Form can be written in the form. Subtract the estimated salvage value of the asset from the cost of the asset to get the.

In other words we can also say that a Linear interpolant is a straight line that exists between the two recognized co-ordinate.

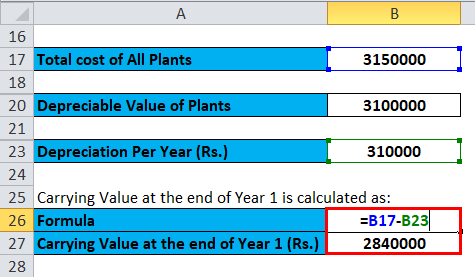

Straight Line Depreciation Formula Calculator Excel Template

How To Calculate Straight Line Depreciation Method Youtube

How To Calculate Straight Line Depreciation Fast Capital 360

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Method Prepnuggets

Straight Line Depreciation Formula Calculator Excel Template

What Is The Volume Of A Conical Flask Which Is 13 Cm In Height With Base Radius Of 6 Cm And An Upper Radius Of 2 Cm Quora

Simpson S Rule Calculator Online Solver With Free Steps

Vertical Angles Vertically Opposite Angles Theorem Proof

Straight Line Depreciation Formula Calculator Excel Template

Byte Calculator Online Solver With Free Steps

Infinite Series Calculator Online Solver With Free Steps

Straight Line Depreciation Formula Calculator Excel Template

Depreciation Formula Examples With Excel Template

Surly Krampus 29 Frameset Nose Drip Curry Westbrook Cycles

Method To Get Straight Line Depreciation Formula Bench Accounting

How To Calculate Straight Line Depreciation Formula